Budget January 2016 ~ Stock market craziness and home renovations

Here is our first report on our 2016 budget. Ever since we decided that the path for us is out of the rat race and into an early retirement of our choosing, the Mr. and I have been keeping an eye on our finances and scaling down our spending. Neither one of us were complete clowns, but we certainly weren't looking out for our future selves at anywhere near the level we want/need to be.

So in comes the budget. Budgets don't work for everyone and in the future, it may not be necessary for us but, for now, it is the way we are buckling down and meeting the tough goals we've set for ourselves. Read more about how we budget here.

We are labeling January the month of stock market craziness and home renovations.

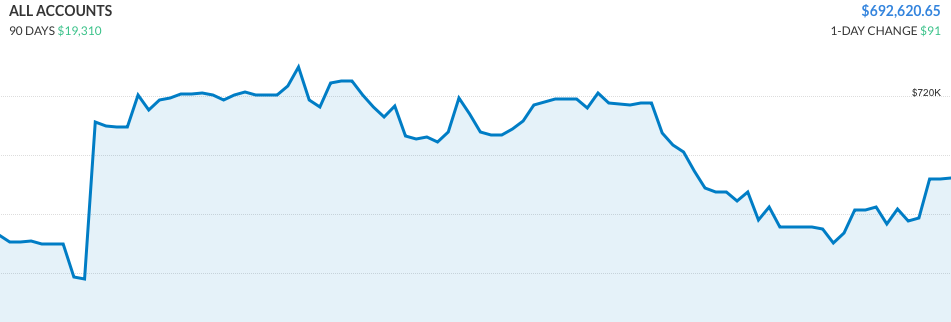

Why? The first one should be obvious. There was a little upswing on the last day of the month which helped our net worth a bit but boy-o-boy January was rough. We kept on business as usual though and are continuing to max out our 401ks. Stocks are on sale right?

As for the home renovations - Steve mentioned in an article last month we are moving up our move date (not our retirement dates, though Steve dreams about it). We are planning to sell our primary residence and move into our Airstream sometime in April rather than in the fall as originally planned. So now is the time when we do all sorts of small renovations on our home, things we like but never got around to doing, for the expressed purpose of selling it. Tough to swallow the extra cost and time associated with the upgrades, but if it helps our bottom line, in the end, it's worth it!

On to the numbers!

- Fixed Costs (Mortgages, HOA, Loans) $2558/ $2558

- Full Time Costs (House renovations, RV costs) $2786/?? New category! I want to keep track of what we spend on the house and expenses specifically related to moving into our Airstream. This month we has both renovation costs and $1000+ for our grandfathered unlimited data plan from Verizon. Yes it was expensive but now we have unlimited data on the road. We're canceling our cable/internet package with Comcast the day after the Superbowl and then the monthly cost is actually a bit less!

- Utilities & Other Necessities (electricity, gas, water, cars, fuel, etc.) $746/$809

- Groceries $410/ $350 We had people in town and decided it would be cheaper to host meals at our house rather than go out. It was as witnessed by our fun money below but it does mean we blew the budget on groceries.

- Fun (Travel, Mr.'s fun money, Mrs.'s fun money, Mr.'s camera fund, gifts, restaurants) $1032/ $1051. We managed to stay under even with people in town, $400 of repair work on Steve's main laptop and other unexpected surprises.

- Additional Income: $560 Payment for the Ridge along with our normal random assortment of checks, interest and other sundries that came in this month. Unexpected money is a plus! We reinvest all our dividends, etc. so those don't get counted in this roundup.

Another great month on the books.

Now, let's take a look at the money-shot numbers.

Total January 2016 income: $10,616

Total January 2016 expenses: $7,535

This means our total January 2016 Take Home Savings Rate came in at 29%. OUCH! Up front expenses suck.

And our January 2016 Total Savings Rate: 50% (includes maxing out our 401ks).

Our net worth: $692,620. Let's see this number grow!

Our Personal Capital Net Worth Chart

We're doing great! Just gotta keep on keeping on.

Another adventure awaits!

-- Groceries: $410.22--

Fruits and Veggies: $257.59

Canned Goods: $33.19

Vegan 'Meat': $12.01

Meat, Seafood and Dairy: $35.66

Dry Goods: $72.37

Minus 60 cents from our bag credits. Gotta love a little extra savings ;)